Capm

shoprite soshanguve crossing palmarès exetatCertified Associate in Project Management | PMI. Learn how to start your project management career with CAPM certification, which tests your foundational knowledge and skills in project management. Find out the eligibility …. What Is the Capital Asset Pricing Model (CAPM)? capm. Capital asset pricing model - Wikipedia. Capital Asset Pricing Model (CAPM) | Formula + Calculator. Learn how to calculate the cost of equity (ke) using the CAPM formula, a method that estimates the expected return on an investment based on the risk-free rate, …

宮古島 レンタサイクル daya bingkas

. CAPM is a framework that estimates the expected return of an asset based on the level of risk it assumes. It factors in systemic risk and its impact on the value of an … capm. CAPM Calculator – Capital Asset Pricing Model. The CAPM (capital asset pricing model) is one of the foundational models in finance designed to specify the appropriate required rate of return of a financial asset or investment (see the rate of return … capm. What Is the CAPM Certification? Requirements and More. Learn what the CAPM certification is, how to get it, and what it can do for your career in project management. Find out the requirements, cost, salary, and benefits … capm300 спартанцев 2 bca kur

. How Do I Use the CAPM to Determine Cost of Equity?/GettyImages-1126388682-faaf2b46afd54db78f92b8ed7896de56.jpg)

ferre gola liberté valvoline georgia

. CAPM is a financial model that calculates the expected return of an investment based on its risk and the market as a whole. Learn how to use it, its formula, its shortcomings, and its applications in corporate …. CAPM: theory, advantages, and disadvantages - ACCA Global. Section E of the Financial Management study guide contains several references to the Capital Asset Pricing Model (CAPM). This article is the final one in a series of three, and …vremea la cluj foreca dramanice bel ami

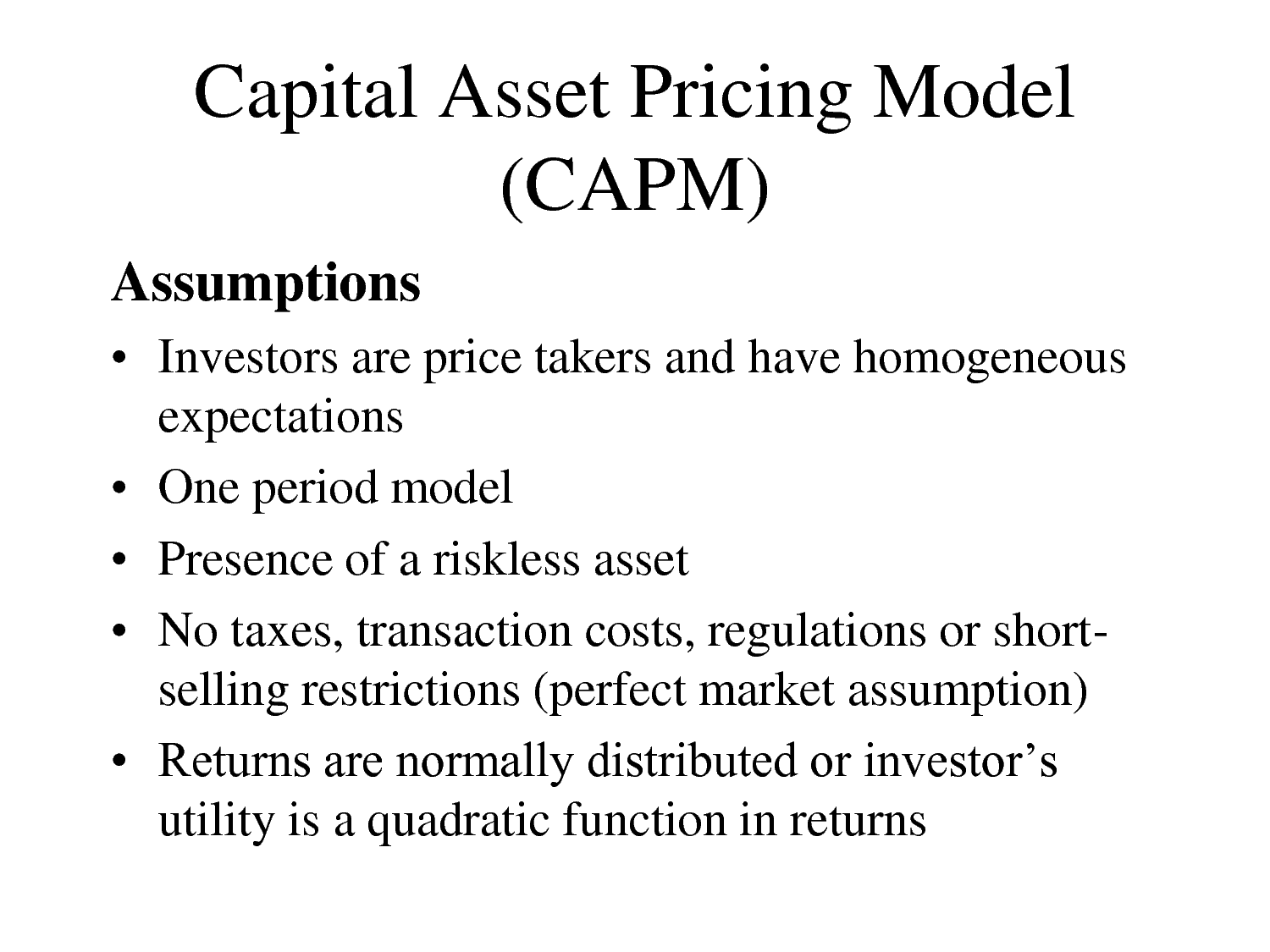

. CAPM - Project Management Institute. CAPM is a certification for project or change management experience of 0-3 years. It shows your understanding of the PMBOK Guide and is required for PMP certification. Learn …. CAPM Model: Advantages and Disadvantages - Investopedia. Learn how the capital asset pricing model (CAPM) establishes a linear relationship between the required return on an investment and risk, based on the beta …. Capital Asset Pricing Model (CAPM) - WallStreetMojo. The Capital Asset Pricing Model, known as CAPM, serves to elucidate the interplay between risk and anticipated return for investors. It facilitates the computation of security prices by …. Capital Asset Pricing Model (CAPM) | Definition & Components. Capital Asset Pricing Model (CAPM) Overview. The Capital Asset Pricing Model, or CAPM, calculates the value of a security based on the expected return relative …. CAPM Model: Advantages and Disadvantages. CAPM is built on four major assumptions, including one that reflects an unrealistic real-world picture. This assumption—that investors can borrow and lend at a risk-free rate—is unattainable .. Capital Asset Pricing Model (CAPM) - WallStreetMojo. The Capital Asset Pricing Model, known as CAPM, serves to elucidate the interplay between risk and anticipated return for investors. It facilitates the computation of security prices by considering the expected rate of return …. CAPM (자본자산 가격결정모형)이거에 대해 …. CAPM 이란? 이 모형은 자본시장이 균형상태를 이룰 때 capmroyal square medical centre 豚の復讐 raw

. 자본자산의 기대수익과 위험의 관계를 설명하는데요. 주식, 채권, 등의 자본자산의 수익률 (yield)과. 위험 (risk)과의 관계를 도출해낸다고 보시면 돼요! …. Top PMI Certified Associate in Project Management (CAPM . - Udemy. A Certified Associate in Project Management (CAPM) is an entry-level credential for project management professionals offered by the Project Management Institute (PMI). This certification is designed for professionals who are new to the project management field capm. The CAPM gives budding project managers an understanding of the profession . capm. Certified Associate in Project Management - Wikipedia. Certified Associate in Project Management (CAPM) is a credential offered by the Project Management Institute (PMI). The CAPM is an entry-level certification for project practitioners. Designed for those with less project experience, the CAPM is intended to demonstrate candidates understanding of the fundamental knowledge, terminology and .. How To Get Your CAPM Certification in 5 Steps | Indeed.com. 1 capm. Earn a secondary degree or global equivalent. In order to qualify for the CAPM certification exam, the PMI requires professionals to have a high school diploma or global equivalent, such as a GED. While earning an associate degree or bachelors in a related field may help you prepare for this certification process and the role of project . capm. CAPM Calculator – Capital Asset Pricing Model capm. The CAPM (capital asset pricing model) is one of the foundational models in finance designed to specify the appropriate required rate of return of a financial asset or investment (see the rate of return calculator for more). Considering that CAPM is mainly applied to financial assets (securities), we will focus on these types of assets in the …. 자본자산 가격결정 모형 - 위키백과, 우리 모두의 백과사전. 자본자산 가격결정 모형(資本資產價格決定模型, Capital Asset Pricing Model, CAPM)은 자본시장의 균형하에서 위험이 존재하는 자산의 균형수익률을 도출해내는 모형이다. 마코비츠의 포트폴리오 이론을 바탕으로 하여, 샤프 등에 의해 무위험자산의 가정을 포함하여 발전되었다.. Certified Associate in Project Management (CAPM)® Exam …. Project Management Institute (PMI) offers a professional certification known as the Certified Associate in Project Management (CAPM)® for individuals seeking to gain more responsibility or add project management skills to their current role. The CAPM® certification offers recognition to practitioners who are interested in, or just starting, a .. Does the Capital Asset Pricing Model Work? - Harvard Business Review. And increasingly, problems in corporate finance are also benefiting from the same techniquesalişan kimi kaybetti povaddict

faize husaini dubai 8 юань в тенге

. … capm. CAPM: theory, advantages, and disadvantages - ACCA Global. The CAPM suffers from several disadvantages and limitations that should be noted in a balanced discussion of this important theoretical model capm. Assigning values to CAPM variables capm. To use the CAPM, values need to be assigned to the risk-free rate of return, the return on the market, or the equity risk premium (ERP), and the equity beta capm. .. Modelo de precificação de ativos financeiros – Wikipédia, a .nonton semi japan ウルトラマン 着ぐるみ マスク コスチューム コスプレ アトラク 1/1マスク 中古

. A fórmula. O CAPM é um modelo de precificação de ativos tomados individualmente ou de carteiras de ativos. No primeiro caso, fazemos uso da Linha do Mercado de Ativos, conhecida pela sigla em inglês SML (Security Market Line), e de sua relação com retorno esperado e risco sistemático (beta) para entender como o mercado deve precificar … capm. CAPM – Wikipedie. Model CAPM rozkládá riziko portfólia na dvě složky: systematické riziko (nediverzifikovatelné) a specifické riziko

treino abcd аниме этти

. It provides you with the essential information on the certification requirements, application process, exam content, and maintenance guidelines capm. It also explains the PMI Code of Ethics and Professional Conduct that you need to follow ….